- ETF UNO

- Posts

- ZROZ Explained: When Patience Pays in Bonds🕰️

ZROZ Explained: When Patience Pays in Bonds🕰️

🎯How PIMCO’s ultra-long bond ETF turns interest-rate moves into opportunity

Hello, valued readers! While many investors flock to broad-market bond ETFs for stability, there exists a specialised instrument designed for investors with a very specific, long-term objective. Today, we’re turning our spotlight on one of the most potent and polarising tools in the bond ETF universe: the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF $ZROZ ( ▲ 0.33% ) .

Suppose your portfolio strategy involves a crystal-clear, decades-long time horizon or you’re looking for a powerful hedge against a deflationary shock. In that case, ZROZ demands a seat at your investment table. Let’s peel back the layers on this unique fund to understand its mechanics, its magnificent potential, and its very real risks.

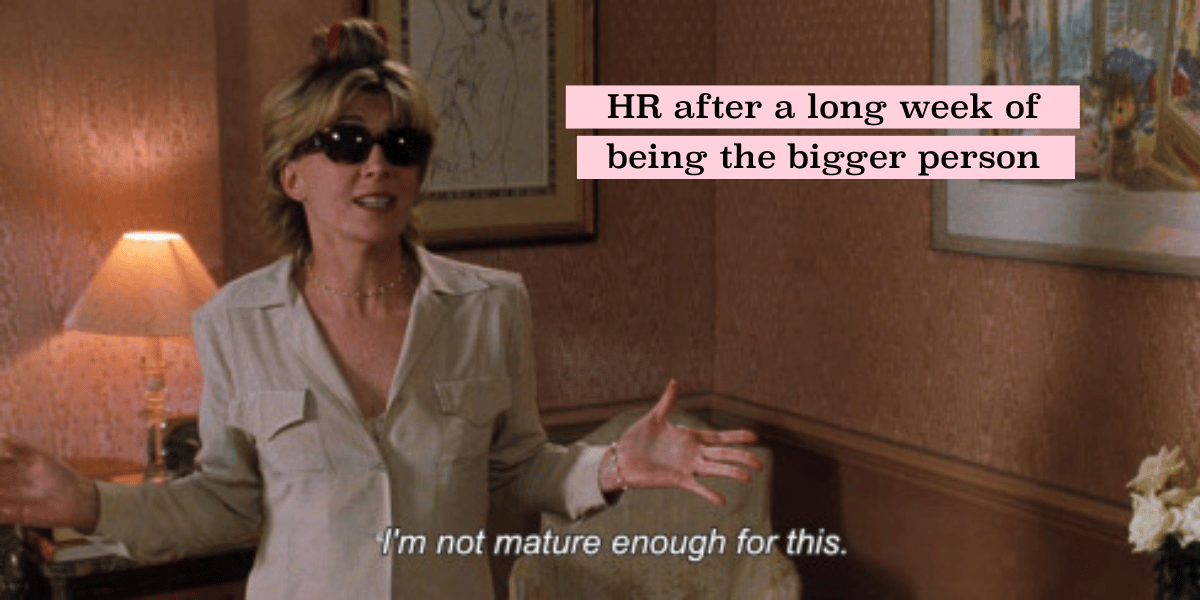

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

What is ZROZ?

ZROZ gives investors access to long-maturity U.S. Treasury “STRIPS” (Separate Trading of Registered Interest and Principal of Securities) with 25 years or more remaining that focus on the principal-only portion of these securities. When you buy ZROZ, you invest in a group of securities that do not pay interest but are sold at a discount, yielding the face value at maturity.

ZROZ is designed for investors looking to increase their interest-rate sensitivity in a straightforward way. If you're interested in bonds beyond the typical 5- or 10-year Treasuries, it offers a more extreme option within fixed income. For context, a 1% change in interest rates will cause the price of ZROZ to move by approximately 25-27% in the opposite direction. That's a level of volatility rarely seen in the supposedly "safe" world of U.S. Treasuries.

ZROZ: High-Volatility, Long-Term Treasury STRIPS

The fund tracks the ICE BofA Long U.S. Treasury Principal STRIPS Index and is managed by PIMCO, a leading fixed-income firm known for its expertise in active bond management. Although ZROZ is an index-tracking ETF, PIMCO's extensive knowledge of the Treasury market gives investors added confidence in its management.

The PIMCO Advantage

Investment Strategy📊

ZROZ is a specialised, high-volatility ETF for sophisticated investors. Due to its extreme sensitivity to interest rates, it should be used strategically and in small allocations within a broader portfolio.

Here are some key investment strategies:

📉Long-Duration Tilt: Add a small allocation (e.g., 5-10%) to ZROZ to extend the duration of a core bond portfolio focused on shorter-term Treasuries. This set-up is effectively a bet on falling or stable interest rates.

🛡️Deflation or Safety Hedge: Use it to hedge against economic slowdowns or deflation, as long-term Treasuries often perform well when other assets like equities decline.

🕒Tactical Position: Temporarily increase exposure when you anticipate a period of interest rate cuts by the Federal Reserve.

⚖️Portfolio Diversification: Its price behaviour is often uncorrelated with equities and traditional coupon-paying bonds, providing potential diversification benefits.

ZROZ: A Tactical Tool for Portfolio Strategy

ZROZ does not pay coupons, making it unsuitable for those seeking regular income. Its high volatility means it should be a "satellite" position in your portfolio, requiring regular rebalancing to avoid becoming too large. Be ready for significant price declines if interest rates rise. In short, ZROZ is a powerful but risky tool that should be used cautiously.

ZROZ at a glance

ETF Issuer: PIMCO

Inception: 2009-10-30

Asset Class: Fixed-Income

Underlying Index: ICE BofA Long U.S. Treasury Principal STRIPS Index

Geographical Focus: U.S.

Expense Ratio: 0.15% (as of last data point)

Dividend Yield: 4.61% (as of last data point)

Distribution Frequency: Quarterly

Historical Performance

ZROZ's performance highlights the risks of duration, closely mirroring the long end of the U.S. Treasury yield curve.

The Golden Age (2012-2020): During a historic bond bull market, ZROZ thrived as yields fell from over 3% to below 1%. From 2009 to August 2020, it delivered outstanding returns, far exceeding its shorter-duration peers and serving as the ultimate "flight to quality" asset.

The Great Reversal (2021-2023): The situation changed dramatically in 2022 with the inflation surge. The Federal Reserve launched an aggressive rate-hiking cycle, driving the 30-year Treasury yield from around 1.2% to over 4%. As a result, the ZROZ ETF suffered a nearly 40% loss that year, highlighting that even U.S. government debt can experience significant price fluctuations under such extreme conditions.

The Recent Bounce (2024-Present): As the market anticipated the end of the rate-hike cycle and future cuts, long bonds rallied in 2024, and ZROZ significantly rebounded, showing strong year-to-date returns.

ZROZ's performance is driven by interest risk, not credit risk. Its chart reflects the market's long-term growth and inflation expectations.

ETF Radar View

The radar chart below shows the general characteristics of the ETF:

ZROZ on the Radar

For each domain, higher scores indicate better suitability for investment

Top 3 Reasons to Invest

Leverage the Long End of the Yield Curve: If you believe interest rates will decline (perhaps because of a recession, Fed policy easing or deflationary pressure), ZROZ may deliver outsized gains. Its long‐duration profile makes it a potential “supercharger” when rates drop.

Powerful Hedge Against Deflationary Shocks: In a world where many investment portfolios are oriented toward inflation protection, ZROZ offers a valuable, asymmetric hedge against the less common but potentially harmful deflationary scenario. If economic data weakens and inflation falls, ZROZ is positioned to benefit.

A Pure Zero-Credit-Risk Asset: The underlying securities are U.S. Treasury principal STRIPS. This pure play means they carry the full faith and credit of the U.S. government—the highest credit quality available. Your risk is purely interest rate risk, not default risk.

Top 3 Reasons Not to Invest

Extreme interest-rate risk: With a long duration of ~28 years, ZROZ is extremely sensitive to changes in interest rates. If rates rise, or inflation expectations climb, the fund could suffer severe losses—much more than typical bond funds. For example, the −41% in 2022 shows what can happen.

Inflation vulnerability: Zero‐coupon long‐dated Treasuries are especially vulnerable when inflation picks up because the nominal payment is fixed in the future and inflation erodes purchasing power. If inflation remains stubborn or rises, ZROZ may underperform.

Timing and market-risk sensitivity: Because this is a more “active bet” (implicitly on rates falling or staying low), it requires timing or at least conviction. If you hold it and rates move the “wrong” way, you may face large drawdowns. The psychological and portfolio‐management demands are higher than for standard bond funds.

ZROZ: The Long Game in U.S. Treasuries🎯

In summary, ZROZ is a powerful fixed-income tool that provides exposure to ultra-long-dated U.S. Treasury zero-coupon bonds through PIMCO and tracks the ICE BofA Long U.S. Treasury Principal STRIPS Index. It is very sensitive to interest rate changes.

If you expect lower interest rates or decreasing inflation, or if you're looking for a unique addition to your equity holdings, ZROZ might be a suitable choice. However, if you desire regular income, are concerned about inflation, or prefer more stability, you should avoid it or limit your allocation. Consider ZROZ as a "5% tactical bond tilt" in your ETF portfolio, but be prepared for a potentially bumpier experience compared to standard bond funds.

ZROZ: A High-Risk, High-Reward Tactical Tool

Thank you for reading! We hope you found this article informative and engaging. If you’re enjoying our in-depth analyses, please consider joining the ETF UNO community by sharing the newsletter, following us, and staying tuned for future ETF spotlights. Until next time, happy investing, and may your portfolio always remain diversified!

DISCLAIMER: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Reply