- ETF UNO

- Posts

- 🎯ULTY ETF Deep Dive: Ultra Income Meets Ultra Risk

🎯ULTY ETF Deep Dive: Ultra Income Meets Ultra Risk

Weekly payouts meet maximum volatility📈

Hello, fellow ETF enthusiasts! Welcome back to ETF UNO, where we explore the world of exchange-traded funds. Today, we’re looking at the YieldMax Ultra Option Income Strategy ETF $ULTY ( ▼ 0.09% ) , a highly talked-about income-generating ETF launched in 2024.

With a distribution yield often exceeding 80% annually and a unique weekly payout schedule, ULTY has certainly caught investors' eyes. However, exceptional yields typically come with significant considerations. Let's delve into this high-yield ETF and see if it belongs in your income-focused ETF portfolio.

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

What is ULTY?

If you know the Global X Nasdaq 100 Covered Call ETF $QYLD ( ▼ 0.7% ) , you'll recognise ULTY's approach. Both ETFs use covered call strategies by selling call options to collect premium income while holding securities. However, ULTY is actively managed and aims to generate monthly income from a portfolio of 15 to 30 underlying securities, primarily chosen based on implied volatility. ULTY's managers actively seek high-volatility opportunities in individual stocks, potentially creating a more focused and lucrative income stream.

ULTY: Covered Call Evolution

ULTY's investment managers regularly review the portfolio to determine whether covered call strategies should be increased, decreased, or eliminated, and whether strategies should be implemented on new underlying securities. This active approach allows the ETF to pivot quickly when volatility patterns change, potentially capturing more option premium during turbulent market periods.

Despite being less than 2 years old, ULTY has rapidly gained traction among investors. The fund shows substantial trading activity with a recent daily volume reaching over 33 million shares. This impressive liquidity profile demonstrates strong investor interest and makes ULTY easily tradeable for both large and small positions.

Investment Strategy📊

The implementation strategies for ULTY must be distinct and innovative, setting them apart from those of traditional broad index ETFs:

🛰️The Income Satellite Approach: Given ULTY's high-risk, high-reward profile, it is best as a satellite holding rather than a core component. Consider allocating 3-7% of your portfolio to ULTY as a speculative income generator.

🧩Diversification Strategy: Don't put all your income into ULTY. To achieve issuer diversification, consider adding other covered call ETFs like the JP Morgan Nasdaq Equity Premium ETF $JEPQ ( ▼ 1.02% ) and QYLD to your portfolio. These alternatives hold actual stocks rather than synthetic derivatives.

♻️DRIP Implementation: If building wealth is a primary goal and you don't need immediate income from dividends, reinvesting through a Dividend Reinvestment Plan (DRIP) can be a great way to compound your growth. This strategy takes advantage of high dividend payouts and relatively low ETF prices.

⚡Tactical Allocation: Consider using ULTY strategically during periods of high volatility when option premiums are elevated. The fund's active management approach aims to capitalise on these conditions, potentially generating higher income during stressed markets.

ULTY Implementation Strategies

ULTY at a glance

ETF Issuer: YieldMax

Inception: 2024-02-28

Asset Class: Equity

Underlying Index: ULTY is an active ETF

Geographical Focus: U.S.

Expense Ratio: 1.40% (as of last data point)

Dividend Yield: 121.58% (as of last data point)

Distribution Frequency: Weekly

Historical Performance

Total Return Reality: ULTY had a total return of 16.61% in the past year, including dividends, with an average annual return of 5.83% since inception. While these numbers might seem modest compared to the advertised yield, they tell the complete story of what investors experience.

Distribution Dynamics: ULTY's weekly cash payouts have declined from more than $1 in 2024 to less than $0.50 in 2025, with recent distributions around $0.10 since May 2025. This dramatic decline illustrates the variability inherent in option income strategies and the importance of looking beyond headline yield figures.

Price Performance Context: The ETF's share price has been extremely volatile, with the biggest drop of 68% since February 2024. Its price range demonstrates the significant volatility that accompanies high-yield option strategies.

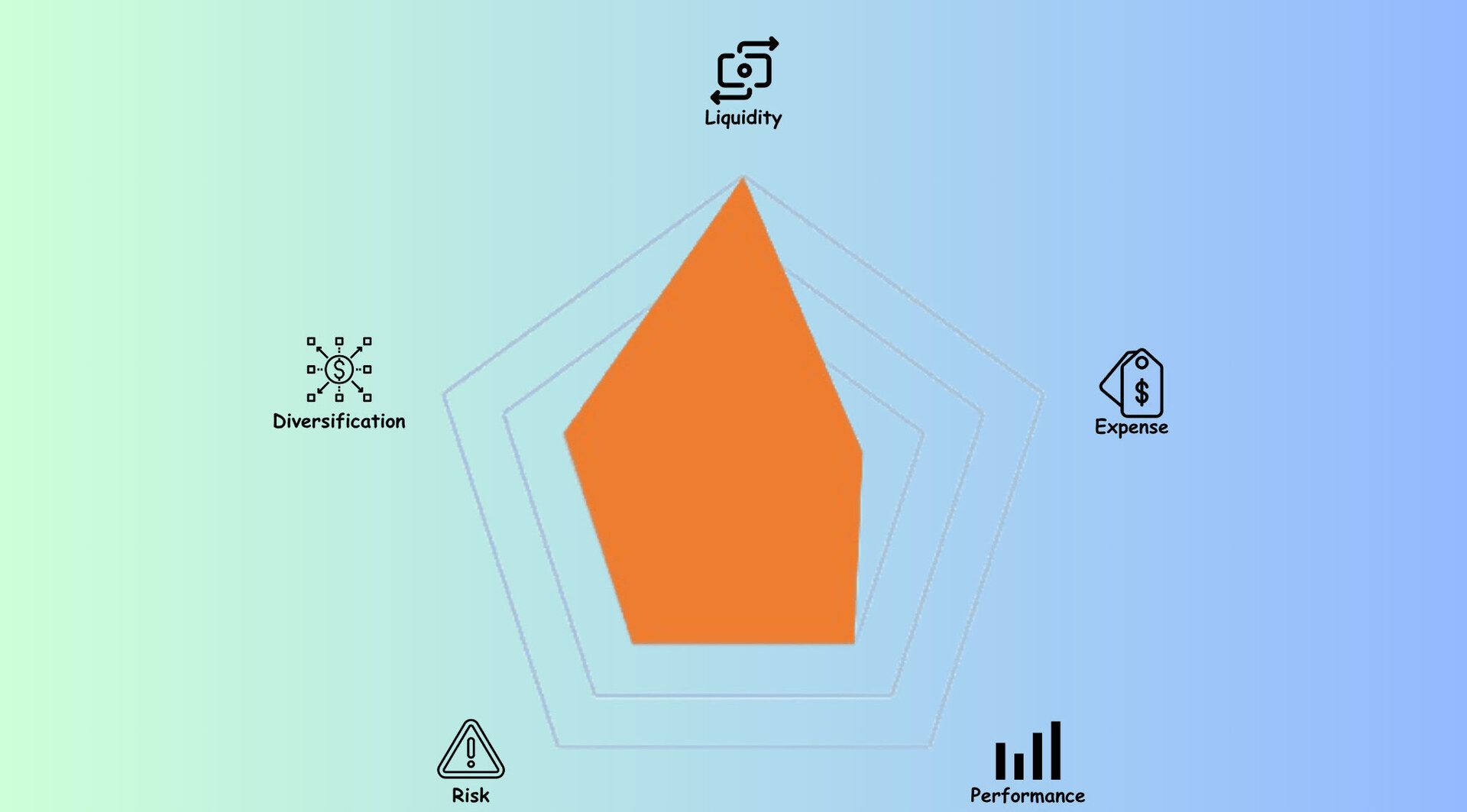

ETF Radar View

The radar chart below shows the general characteristics of the ETF:

ULTY on the Radar

For each domain, higher scores indicate better suitability for investment

Top 3 Reasons to Invest

Exceptional Income Generation: ULTY maintains a dividend yield of >100% and pays weekly distributions, providing one of the highest income streams available in the ETF universe. For investors prioritising current income over capital appreciation, few options can match ULTY's cash generation potential.

Professional Active Management: Unlike passive covered call strategies, ULTY benefits from experienced managers who can adapt to changing market conditions. The ability to adjust position sizes, select optimal underlying securities, and time option strategies based on volatility patterns adds significant value during turbulent periods.

Weekly Cash Flow: The ETF transitioned to a weekly payout schedule in early 2025, enhancing its appeal to investors who prioritise consistent and frequent cash flow. This frequent distribution schedule is particularly attractive for retirees or those using the income for regular expenses.

Top 3 Reasons Not to Invest

Severe Capital Erosion Risk: Due to ULTY's investment strategy, the fund's indirect exposure to gains is capped, but it's subject to all potential losses if underlying securities decrease in value, which may not be offset by income received. The 68% decline since inception starkly illustrates this asymmetric risk profile.

High Expense Burden: The YieldMax Ultra Option Income Strategy ETF deducts 1.40% worth of annual operating expenses from the share price. This high expense ratio significantly impacts total returns, especially during periods of modest performance.

Unpredictable Distribution Sustainability: The most recent distribution contains 100% return of capital and 0% income, highlighting how these distributions largely represent a return of your own invested capital rather than genuine investment income. Future distribution rates remain highly uncertain and could decline significantly.

ULTY: 121% Yield with a Reality Check📊

The YieldMax Ultra Option Income Strategy ETF represents a fascinating experiment in active income generation through sophisticated options strategies. While ULTY offers compelling features—exceptional yield potential, professional management, frequent distributions, and tax-efficient structures—it demands careful consideration of its substantial risks.

For risk-tolerant investors seeking high current income and willing to accept substantial volatility, ULTY offers a unique proposition. However, conservative investors should approach with extreme caution, and even aggressive investors should limit position sizes to amounts they can afford to lose.

Remember, successful ETF investing requires continuous learning and adaptation. As market conditions evolve, so too should our understanding of complex instruments like ULTY.

ULTY: Exceptional Yield, Exceptional Risk via Options

Subscribe to ETF UNO and never miss an opportunity to optimise your ETF portfolio. Connect with like-minded investors, access exclusive research, and stay ahead of the latest ETF trends that could transform your portfolio. Whether you're exploring high-yield strategies like ULTY or seeking stable core holdings, our community provides the insights and discussions you need to make informed investment decisions.

DISCLAIMER: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Reply