- ETF UNO

- Posts

- 🔄The Best of Both Worlds: Why CWB ETF is Redefining the Stock-Bond Balance

🔄The Best of Both Worlds: Why CWB ETF is Redefining the Stock-Bond Balance

Your gateway to convertible securities magic✨

In today's volatile markets, investors are increasingly looking for assets that provide both growth potential and downside protection. While most investors are familiar with stocks and bonds as separate asset classes, convertible securities represent an intriguing middle ground that combines elements of both. The SPDR Bloomberg Convertible Securities ETF $CWB ( ▼ 0.36% ) is a unique ETF that offers diversified exposure to a relatively obscure segment of the market: convertible bonds. CWB is therefore a worthwhile option for those seeking to diversify their portfolios beyond traditional asset allocation strategies.

Where Accomplished Wealth Builders Connect, Learn & Grow

Long Angle is a private, vetted community for high-net-worth entrepreneurs and executives. No fees, no pitches—just real peers navigating wealth at your level. Inside, you’ll find:

Self-made professionals, 30–55, $5M–$100M net worth

Confidential conversations, peer advisory groups, live meetups

Institutional-grade investments, $100M+ deployed annually

What is CWB?

A convertible security is a security—such as bonds or notes—that holders can convert into different securities, typically shares of the company's common stock. Think of it as a bond with a built-in option to become stock under certain conditions. A convertible bond is a regular corporate bond that has the added feature of being convertible into a fixed number of shares of common stock.

Convertible securities are appealing due to their hybrid nature. They provide downside risk protection like bonds while offering the potential for equity-like gains. If the underlying stock performs well, holders can convert to equity and benefit from the gains. If the market drops, the bond component offers a protective cushion.

Convertibles: Capital Protection with Equity Upside

The SPDR Bloomberg Convertible Securities ETF focuses on the convertible securities market by tracking the Bloomberg US Convertible Liquid Bond Index. It aims to invest in U.S. convertible securities that have an issue amount of at least $350 million and an outstanding par amount of at least $250 million, ensuring both liquidity and institutional quality.

Investment Strategy📊

Incorporating CWB into your portfolio is an exciting opportunity! Assess your asset allocation and investment goals. Here are some strategies to explore:

💡Bond Alternative with Upside: Given their historically low correlation to interest rate-sensitive bonds and higher yield than the Agg, convertibles could serve as a complement to the core fixed-income allocation to increase fixed income portfolio diversification and potentially enhance yields. Consider allocating 5-15% of your fixed income sleeve to CWB instead of traditional corporate bonds.

🛡️Equity Volatility Reducer: For investors seeking to lower the volatility of their equity portfolio, convertibles could act as a defensive growth equity exposure. Replace a portion of your small-cap or growth allocation with CWB to maintain upside participation while reducing overall portfolio volatility.

🎯Tactical Allocation Play: CWB has a stronger correlation with stocks than with bonds and should be handled like a low-volatility equity ETF. Use CWB as a tactical allocation when you're moderately bullish on equities but want downside protection.

🌉Interest Rate Hedge: In rising rate environments, CWB can serve as a bridge between traditional bonds (which suffer) and pure equity exposure (which may benefit from economic growth driving rate increases).

CWB Strategies: Diversify, Defend, Adapt

CWB at a glance

ETF Issuer: SPDR

Inception: 2009-04-14

Asset Class: Fixed-Income (with equity exposure through convertibles)

Underlying Index: Bloomberg US Convertible Liquid Bond Index

Geographical Focus: U.S.

Expense Ratio: 0.40% (as of last data point)

Dividend Yield: 1.86% (as of last data point)

Distribution Frequency: Monthly

Historical Performance

CWB recorded a total return of 18.20% over the past year and an average annual return of 10.98% since inception. This performance showcases its ability to deliver consistent returns, participating in market rallies while providing downside protection.

In bull markets, CWB captures significant equity gains, while its bond component offers cushioning in bear markets, reflecting its hybrid nature.

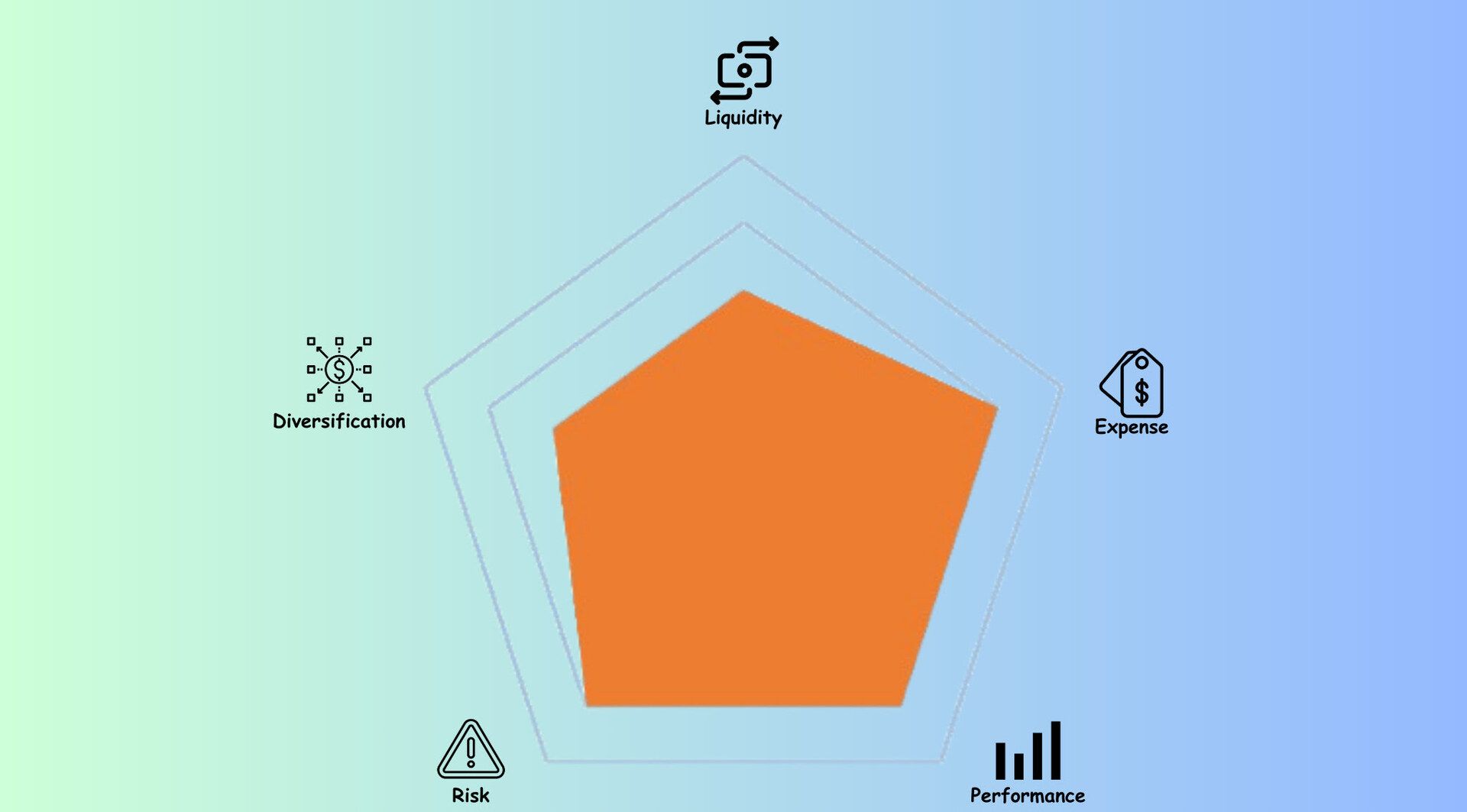

ETF Radar View

The radar chart below shows the general characteristics of the ETF:

CWB on the Radar

For each domain, higher scores indicate better suitability for investment

Top 3 Reasons to Invest

Unique Market Access: This unique ETF is the only product on the market that offers investors diversified exposure to a relatively obscure sector of the market: convertible bonds. You're gaining access to an almost $400 billion global asset class that was previously difficult for retail investors to access efficiently.

Enhanced Risk-Adjusted Returns: Convertible securities have offered equity-like return potential with reduced volatility, allowing for gains during market ups and benefiting from protection when markets decline. The asymmetric risk/reward profile makes CWB attractive for risk-conscious growth investors.

Inflation and Rate Protection: Convertibles may be an especially attractive way for a company to access the capital markets when interest rates are high, and their equity characteristics help protect against inflation better than traditional bonds.

Top 3 Reasons Not to Invest

Complexity and Understanding Gap: Convertible securities are more complex than traditional stocks or bonds. Both investors and companies should understand that market price-based convertible security deals can affect the company and possibly lower the value of its securities. If you prefer straightforward investments, CWB might not be for you.

Limited Pure Bond Benefits: Convertible securities generally provide yields higher than the underlying stocks, but usually lower than comparable non-convertible securities, in exchange for limited upside potential. If you need maximum current income, traditional high-yield bonds might serve you better.

Credit Quality Concerns: CWB holds a portfolio of over 300 convertible securities, mostly without a credit rating. Issuers of convertible securities may not be as financially strong as those issuing securities with higher credit ratings and may be more vulnerable to changes in the economy.

⚡CWB: The Hybrid Investment

CWB offers a great opportunity to access the convertible securities market at a cost-effective price. These securities stand out today due to favourable issuance terms and structural features, making a portfolio of these a strong option for ETF UNO readers seeking to diversify beyond traditional stocks and bonds.

CWB serves as a valuable alternative to bonds, reduces equity volatility, and enhances strategic allocations. Its blend of equity upside and bond-like protection helps investors navigate growth opportunities while managing risks in today’s unpredictable market.

CWB: Cost-Efficient Growth & Guardrails

Looking for innovative ETF strategies and a community of forward-thinking investors? Join the ETF UNO community to explore specialised sectors, performance analyses, and strategic portfolio ideas. Our newsletter delivers the insights you need for informed investment decisions.

DISCLAIMER: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Reply