- ETF UNO

- Posts

- 🎯The 35-Stock Gamble: Why Alger's Concentrated ETF Is Turning Heads in 2025

🎯The 35-Stock Gamble: Why Alger's Concentrated ETF Is Turning Heads in 2025

📊The promise and peril of concentrated active ETFs

Greetings to all ETF UNO readers! Welcome to February 2026. In today's ETF landscape, where passive indexing dominates headlines and low-cost beta reigns supreme, an intriguing counter-movement is emerging: the rise of high-conviction active ETFs. A notable example is the Alger 35 ETF $ATFV ( ▲ 0.12% ) , which has a concentrated portfolio, raising a thought-provoking question: Can fewer holdings lead to better investment outcomes?

Money Management Making You Mad?

Most business owners hit revenue goals and still feel cash-strapped.

Not because they're not making money. But because their money flow is broken, their decisions feel urgent instead of strategic, and their systems feel fragile instead of solid.

The Find Your Flow Assessment pinpoints exactly where friction shows up between your business and personal finances.

5 minutes with the Assessment gets you clarity on:

where cash leaks

what slows progress,

whether your current setup actually serves you

No spreadsheets, or pitch. Just actionable insight into what's not working and why.

Educational only. Not investment or tax advice.

What is ATFV?

Launched in May 2021 by Fred Alger Management—a firm with deep roots in growth equity investing since 1964—ATFV represents a bold bet on fundamental research and manager conviction. Unlike the sprawling 500-stock portfolios many investors have grown accustomed to, this ETF deliberately narrows its focus to approximately 35 hand-selected U.S. growth companies across market capitalisations. It's not merely an ETF with a number in its name; it's a philosophy crystallised into a ticker symbol.

Focused Conviction: The Concentrated Growth ETF

To safeguard its investment strategy, the ATFV ETF uses a non-transparent structure. This means that its portfolio holdings are not disclosed daily, which prevents others from copying its trades and enables more strategic positioning. The fund aims for long-term growth by selecting companies that exhibit strong, sustainable advantages, such as competitive moats, innovation, and excellent management.

Protected Strategy, Focused on Long-Term Growth

Dan Chung has served as Alger's Chief Executive Officer and Chief Investment Officer since 2006. He co-manages the ATFV fund alongside George Ortega. Chung's investment philosophy focuses on identifying companies well-positioned to benefit from major secular trends, particularly in artificial intelligence, cloud computing, and digital transformation. He emphasises the importance of rigorous fundamental analysis in this process. In a recent interview, Chung stated, "This is an AI boom, not a bubble," underscoring the team's strong belief in the structural technological shifts driving long-term value creation.

The Alger 35 ETF delivered an impressive 38% return in 2025, significantly outperforming its Large Growth category peers, which averaged a 16% gain. This performance reinforced ATFV's reputation as a high-conviction growth investment.

While mining and precious metals ETFs led the overall market amid a commodities rally, ATFV distinguished itself in the U.S. growth equity space, showcasing the power of concentrated active management over passive indexing.

Dan Chung's team demonstrated expertise in identifying companies poised to benefit from trends such as artificial intelligence and digital transformation. For growth-focused investors, ATFV's 2025 results highlight how fewer, high-conviction ideas can meaningfully outperform when backed by thorough research and timely execution.

The Alger 35 ETF's 2025 Triumph: Focus Over Breadth

Investment Strategy📊

For ETF investors constructing diversified portfolios, ATFV shouldn't serve as a core holding, replacing broad-market exposure. Instead, consider these strategic implementation approaches:

🛰️Equity Satellite Strategy: Consider allocating 5–10% of your equity investment to ATFV as a high-conviction satellite position in addition to core holdings. This approach offers concentrated growth opportunities without significantly increasing your portfolio's risk exposure.

🏋️Barbell Approach: Combine ATFV with a low-volatility ETF on one side and broad market exposure on the other. This creates a risk-return barbell, capturing gains from Alger's concentrated picks while reducing overall portfolio volatility.

🔀Thematic Overlay: If you believe in the potential of U.S. growth equities and want active management to navigate valuation extremes, ATFV can enhance passive growth ETFs by helping to avoid overvalued stocks through active security selection.

⚖️Rebalancing Discipline: Given ATFV's concentrated nature and higher volatility profile, implement strict rebalancing rules—perhaps quarterly—to prevent the position from drifting beyond your intended allocation during strong performance periods.

ATFV at a glance

ETF Issuer: Fred Alger Management

Inception: 2021-05-03

Asset Class: Equity

Underlying Index: ATFV is an active ETF

Geographical Focus: Global

Expense Ratio: 0.55% (as of last data point)

Dividend Yield: 0.21% (as of last data point)

Distribution Frequency: Annual

Historical Performance

ATFV's performance history reflects its focused investment strategy. This outperformance illustrates the potential rewards of high-conviction positioning in strong-growth market environments.

However, concentration has its downsides. During market corrections or shifts away from growth stocks, ATFV has experienced sharper declines compared to more diversified peers. As of late 2025, its three-year annualised return is in the mid-teens—respectable but not extraordinary. This highlights how concentrated strategies can deliver impressive short-term results while struggling to maintain consistency throughout full market cycles.

The fund's expense ratio of 0.55% sits above passive alternatives but remains competitive within the active ETF space. For context, this is less than half the cost of many actively managed mutual funds pursuing similar strategies—a meaningful advantage for long-term compounding.

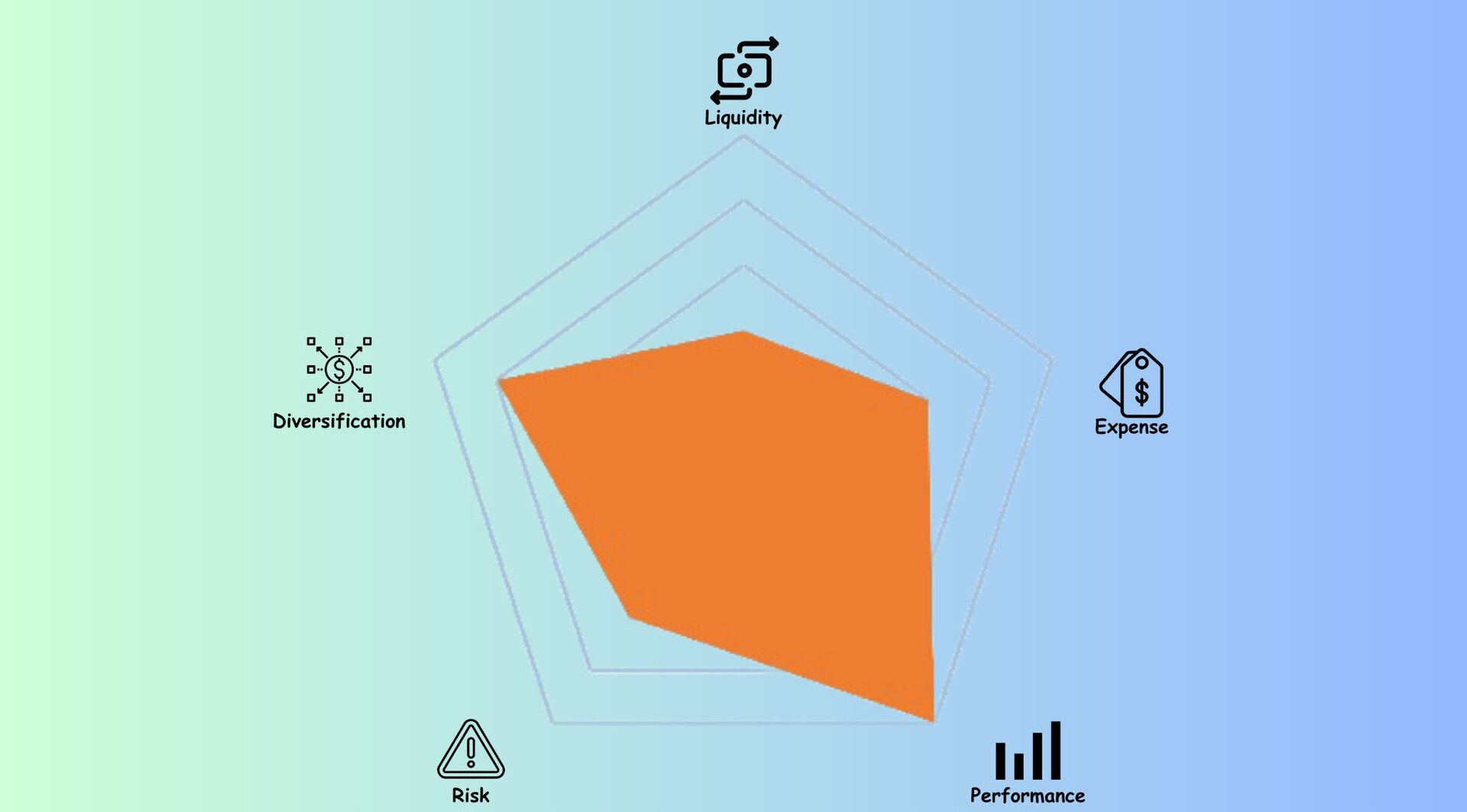

ETF Radar View

The radar chart below shows the general characteristics of the ETF:

ATFV on the Radar

For each domain, higher scores indicate better suitability for investment

Top 3 Reasons to Invest

Manager Conviction Without Mutual Fund Frictions: Dan Chung and George Ortega manage significant personal assets alongside client assets, aligning their interests. Unlike traditional mutual funds, which face daily liquidity demands and tax inefficiencies, ATFV operates as an ETF, offering intraday liquidity, tax efficiency through in-kind transactions, and no minimum investment requirements.

Secular Growth Exposure with Active Risk Management: While passive growth ETFs hold every company in their index regardless of valuation, ATFV's team can adjust positions by trimming excessive holdings or increasing investment in strengthening companies. This flexibility was valuable during the 2022 growth stock correction, allowing active managers to redeploy capital at attractive entry points.

Focused Portfolio Amplifies High-Conviction Ideas: The ETF contains around 35 high-conviction holdings, unlike the hundreds in typical active funds. There are no "closet index" fillers to dilute performance. When Alger's research identifies a strong opportunity, it carries significant weight, potentially enhancing returns if the thesis proves correct.

Top 3 Reasons Not to Invest

Performance Chasing Danger: Strong recent returns tempt investors to buy at cyclical peaks. Growth stocks have historically experienced violent mean reversion. ATFV's strategy works brilliantly in growth-favourable environments but can underperform significantly during value rotations or rising rate environments.

Limited Track Record: Launched in May 2021, ATFV hasn't yet navigated a full market cycle independently. While Alger's firm has decades of experience, this specific ETF structure and concentrated mandate lack the multi-cycle validation many prudent investors require before meaningful allocation.

Opacity Creates Blind Spots: The non-transparent structure that protects Alger's strategy also prevents investors from knowing their exact exposure. You cannot assess sector concentration, overlap with other holdings, or position sizing until quarterly disclosures are available—potentially creating unintended concentration risks in your broader portfolio.

🚀Fewer Holdings, Bolder Bets

The Alger 35 ETF represents an intriguing evolution in active management—merging the depth of fundamental research with the structural advantages of ETFs. It's not a "set-and-forget" core holding, nor should it replace diversified market exposure. But for investors with high risk tolerance, long time horizons, and conviction in U.S. growth equities, ATFV offers a compelling satellite option backed by experienced management.

Success with concentrated strategies demands emotional discipline: the ability to hold through volatility, resist performance-chasing impulses, and maintain appropriate position sizing. As with any high-conviction investment, ATFV works best when understood not as a magic bullet, but as one specialised tool within a thoughtfully constructed portfolio.

Overall Rating of 5-star among Large Growth Funds

Are you excited to explore beyond just the basics of returns? In the ETF UNO community, we dive into the fascinating intricacies of ETF construction and management. Join us to uncover the factors driving performance and connect with fellow investors who value strategic thinking as much as achieving results!

DISCLAIMER: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Reply