- ETF UNO

- Posts

- 🌍Going Global: Why BNDX Deserves a Spot in Your Bond Portfolio

🌍Going Global: Why BNDX Deserves a Spot in Your Bond Portfolio

📈Outperforming domestic bonds with lower volatility

Hello ETF UNO community! Today, we're exploring a fund that has been quietly outperforming its more famous domestic cousin while offering something many investors overlook: global bond market exposure. Meet the Vanguard Total International Bond ETF $BNDX ( ▲ 0.11% ) , a fund that's making a compelling case for why your bond allocation shouldn't stop at America's borders.

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

What is BNDX?

The Vanguard Total International Bond ETF (BNDX), launched in 2013, provides broad exposure to global bond markets outside the United States. It tracks the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged), offering a diversified portfolio of investment-grade, non-US dollar-denominated bonds while hedging currency risk. With a current yield of around 4.32%, BNDX is an appealing option for investors seeking to diversify their international bond holdings and generate income.

Powering Energy Transition & AI Demand Through 2050

For ETF UNO readers who are familiar with $BND ( ▼ 0.01% ) (which we've discussed extensively), BNDX serves as the natural international counterpart to domestic bond exposure. While BND focuses solely on U.S. bonds, BNDX provides access to a much larger market—international bonds account for approximately 52% of the global bond market. However, many U.S. investors tend to overlook this significant opportunity.

BNDX heavily favours government debt, as its market-cap weighting emphasises the largest global bond issuers. This results in significant exposure to high-quality sovereign debt from developed countries, including Japan, Germany, France, and the UK, all known for their strong credit profiles and liquid bond markets.

BNDX's Global Sovereign Debt Outshines BND

Investment Strategy📊

There are several approaches to consider when implementing BNDX in your ETF Portfolio:

🧩Core-Satellite Approach: BNDX works exceptionally well as a satellite holding to complement a core BND position. Vanguard suggests that investors should allocate 30% of their total fixed income exposure to international bonds, making BNDX a natural choice for this allocation.

☔Risk Diversification Strategy: BNDX's maximum drawdowns tend to be smaller than those of BND, due to its broader geographic exposure. This lower volatility profile makes BNDX attractive for conservative investors seeking to reduce overall portfolio risk.

🏋️Barbell Strategy: More sophisticated investors might use BNDX alongside shorter-duration domestic bonds, creating a barbell effect that balances duration risk while maintaining international diversification.

🌲All-Weather Allocation: BNDX can serve as a permanent allocation within a multi-asset portfolio, providing steady diversification benefits across various market cycles. The currency hedging removes one layer of complexity while maintaining the fundamental diversification benefits of international bond exposure.

BNDX at a glance

ETF Issuer: Vanguard

Inception: 2013-05-31

Asset Class: Fixed-Income

Underlying Index: Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged)

Geographical Focus: Global (non U.S.)

Expense Ratio: 0.07% (as of last data point)

Dividend Yield: 4.32% (as of last data point)

Distribution Frequency: Monthly

Historical Performance

Since its 2013 inception, BNDX has demonstrated the value of international bond diversification. The ETF has shown particular strength during periods of market stress.

Recent Performance Highlights:

2025 YTD: +2.0%

1-Year Return: +6.2%

3-Year Average: +3.6%

5-Year Average: 0.01%

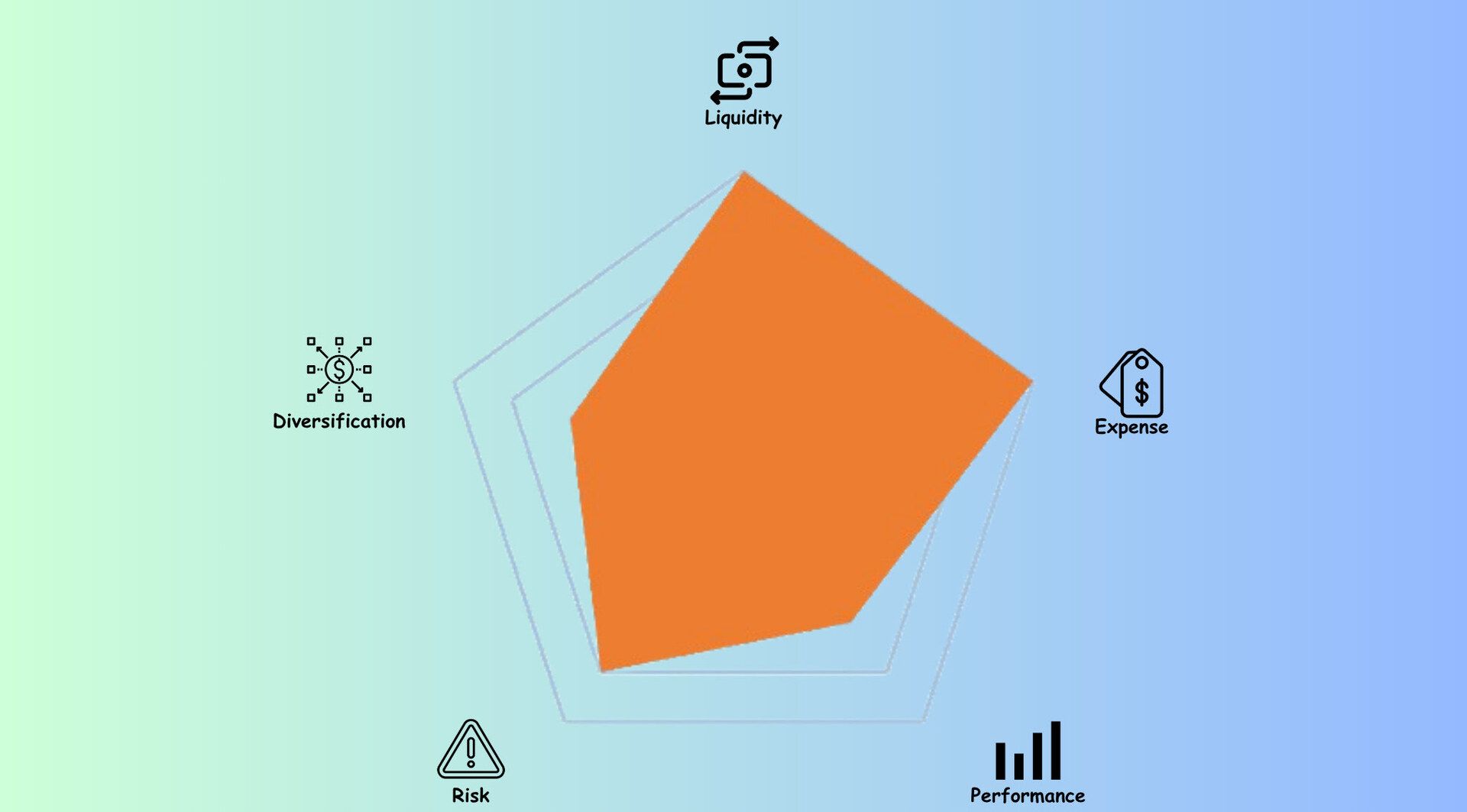

ETF Radar View

The radar chart below shows the general characteristics of the ETF:

BNDX on the Radar

For each domain, higher scores indicate better suitability for investment

Top 3 Reasons to Invest

Superior Diversification Benefits: International bonds provide exposure to different economic cycles, monetary policies, and interest rate environments. While the Federal Reserve's policies directly impact U.S. bonds, BNDX includes exposure to the European Central Bank, the Bank of Japan, and other major central banks, each operating on potentially different timelines and with distinct priorities.

Enhanced Risk-Adjusted Returns: The data shows BNDX's volatility running at roughly half that of BND across multiple timeframes, while delivering competitive returns. This combination of lower volatility with solid performance creates an attractive risk-adjusted return profile that can improve overall portfolio efficiency.

Currency Hedging Removes Complexity: Unlike unhedged international bond funds, BNDX hedges currency exposure back to the U.S. dollar, removing the additional volatility layer that currency fluctuations can introduce. This makes BNDX behave more like a traditional bond fund while still providing the fundamental diversification benefits of international exposure.

Top 3 Reasons Not to Invest

Political and Regulatory Risk Exposure: International bonds expose investors to foreign political and regulatory risks that are not present with domestic bonds. Changes in foreign government policies, tax laws, or regulatory frameworks can impact bond performance in ways that are difficult to predict or hedge against.

Complexity in Tax Reporting: International bond funds can create additional tax complexity, particularly regarding foreign tax credits and varying interest payment schedules. While not overwhelming, this does add a layer of complexity that some investors prefer to avoid.

Tracking Error and Implementation Costs: While BNDX's 0.07% expense ratio is low, it's still higher than BND's 0.03% expense ratio. Additionally, the complexity of tracking an international index can introduce small tracking errors that don't exist with purely domestic funds.

🎯How BNDX Transforms Your Bond Allocation Strategy

BNDX represents a sophisticated approach to bond investing that acknowledges the reality of today's interconnected global markets. With international bonds representing 24% of the liquid, investable market and 52% of the global bond market, excluding them from your portfolio means missing out on a significant portion of the opportunity set.

The recent performance data makes a compelling case: while domestic bonds have struggled, BNDX has provided better returns with lower volatility. The fund's currency hedging removes much of the complexity while preserving the diversification benefits, making it accessible to a broad range of investors.

For ETF UNO readers building robust, diversified portfolios, BNDX deserves serious consideration as either a core holding or a significant satellite position. Whether you're looking to reduce portfolio volatility, enhance diversification, or access the broader opportunities that global markets provide, BNDX offers a professionally managed, cost-effective solution that has proven its worth across various market cycles.

BNDX: The Global Bond Case

Ready to take your ETF knowledge to the next level? Join the ETF UNO community for more deep-dive analysis, portfolio strategies, and insights that help you build better investment outcomes. Subscribe today and never miss our latest research on the ETFs that matter most to your portfolio success.

DISCLAIMER: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Reply