- ETF UNO

- Posts

- 🏛️Ciao Bella Returns: The iShares MSCI Italy ETF Renaissance Story

🏛️Ciao Bella Returns: The iShares MSCI Italy ETF Renaissance Story

🚀G7 strength meets Mediterranean opportunity

Hello, ETF UNO readers! While many investors concentrate on the economic powerhouses of Germany and France, there's a Mediterranean gem that deserves your attention: Italy. Today, we will explore the iShares MSCI Italy ETF $EWI ( ▲ 1.18% ) , an attractive investment option that provides direct exposure to one of Europe's most dynamic yet often overlooked markets.

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

What is EWI?

EWI aims to track the investment results of the MSCI Italy 25/50 Index, providing investors with targeted exposure to the Italian equity market. Launched on March 12, 1996, this ETF has provided access to the Italian market for almost three decades, making it one of the most established single-country European ETFs available. The ETF invests in stocks of companies across diverse sectors, focusing on both growth and value stocks with various market capitalisations.

EWI Offers Decades of Italian Equity Exposure

Much like its European siblings, EWG (Germany) and EWQ (France), EWI aims to represent a unified view of a single Eurozone country. However, Italy often flies under the radar despite being a G7 member and the Eurozone's third-largest economy. This oversight creates compelling opportunities for savvy investors.

Italy became the world's fourth-largest exporter in 2024, overtaking Japan for the first time – a remarkable achievement considering Italy's working population is just 23.7 million compared to Japan's 69.3 million. Italian exports have grown steadily from €480 billion in 2016 to €626 billion in 2023, with forecasts suggesting they'll reach €680 billion in 2025.

The EWI holds fewer than 30 core positions, concentrated in Italy's industrial champions. The top holdings include UniCredit S.p.A., Intesa Sanpaolo S.p.A., Enel SpA and Ferrari N.V.. These aren't merely local players – they're global leaders in banking, energy, luxury automotive, and aerospace defence.

Ferrari continues to be among the world's most valuable car companies

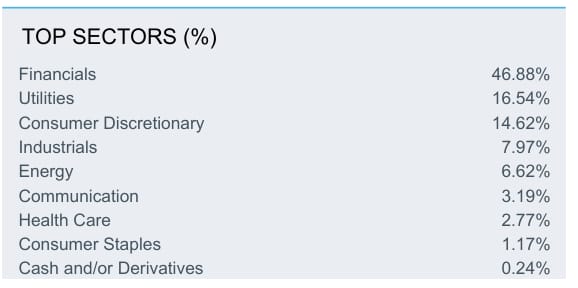

The ETF's sector allocation reflects Italy's economic strengths, with the following allocations: Financial Services (46.88%), Utilities (16.54%), Consumer Discretionary (14.62%), and Industrials (7.97%). This concentration in fundamental economic sectors provides stability while offering exposure to Italy's world-renowned luxury and industrial expertise.

EWI Sector Breakdowns (Source: iShares Site)

Investment Strategy📊

Integrating EWI into your ETF portfolio requires thoughtful consideration of your portfolio allocation strategy:

🛰️Core-Satellite Approach: Use EWI as a 2-5% satellite position within a broader European allocation. This strategy offers targeted exposure to Italy's strengths without overexposing your portfolio to single-country risk.

🌍 Regional Rotation Strategy: EWI pairs well with other single-country European ETFs for tactical allocation adjustments. When Italian economic indicators improve relative to those of other Eurozone members, increasing the EWI allocation can capture outperformance.

💎Value-Oriented Complement: With a P/E ratio of 12.50, Italian equities trade at attractive valuations compared to many developed markets. EWI can serve as a value complement to growth-oriented U.S. positions.

💶Currency Diversification: EWI provides natural EUR exposure, helping to diversify currency risk in dollar-heavy portfolios while maintaining stability in developed markets.

EWI at a glance

ETF Issuer: iShares

Inception: 1996-03-12

Asset Class: Equity

Underlying Index: MSCI Italy 25/50 Index

Geographical Focus: Italy (Eurozone)

Expense Ratio: 0.50% (as of last data point)

Dividend Yield: 2.88% (as of last data point)

Distribution Frequency: Semi-Annual

Historical Performance

EWI returned 30.34% in 2023, followed by 10.39% in 2024. Year-to-date 2025 performance shows 36.32% returns, demonstrating continued momentum.

The ETF's performance history reveals Italy's economic cycles. During the 2008 financial crisis, EWI declined 46.83%, but recovered with 22.02% gains in 2009. This pattern of sharp declines followed by robust recoveries characterises Italian equity markets, rewarding patient investors who can stomach volatility.

Since its inception, EWI has generated an average annual return of 5.79%, which is competitive with many developed market indices, considering dividend income and the benefits of geographic diversification.

ETF Radar View

The radar chart below shows the general characteristics of the ETF:

EWI on the Radar

For each domain, higher scores indicate better suitability for investment

Top 3 Reasons to Invest

Attractive Valuations in a Quality Market: Italian equities trade at compelling valuations relative to other developed markets. EWI's P/E ratio of 12.50 represents significant value compared to U.S. markets, while still providing exposure to established, profitable companies rather than speculative growth stories.

Export Powerhouse with Global Reach: Italy's transformation into the world's fourth-largest exporter reflects deep structural improvements in competitiveness. Companies in luxury goods, fashion, precision engineering, pharmaceuticals, and agri-food sectors export up to 70% of their production, providing natural revenue diversification beyond domestic Italian demand.

Sector Leadership in Future-Focused Industries: Italy isn't just about pasta and fashion. The country leads in renewable energy infrastructure, precision manufacturing, and luxury automotive. Enel, a top EWI holding, is a global leader in renewable energy, while Ferrari represents the pinnacle of automotive engineering and brand value.

Top 3 Reasons Not to Invest

Concentration Risk and Limited Diversification: EWI is not suitable for investors seeking broad diversification across Europe, as many large-cap companies are also represented in other European funds. The concentrated holdings mean that the performance of individual companies has a significant impact on overall returns.

Economic Growth Challenges: Italy faces headwinds from potential U.S. trade tariffs affecting goods exports, and the debt ratio is projected to rise to 138.2% by 2026. While manageable, high debt levels limit fiscal flexibility during economic stress.

Currency and Political Risk: Euro exposure adds currency volatility for U.S. investors, while Italy's complex political landscape can create uncertainty. Coalition governments and frequent political changes can impact market confidence and policy consistency.

🍝Why EWI Deserves a Seat at Your Investment Table

The iShares MSCI Italy ETF offers a valuable opportunity to invest in one of Europe’s strong yet underappreciated economies. With attractive valuations and improving economic fundamentals, Italy is a worthwhile consideration for well-diversified portfolios.

While risks like volatility require careful position sizing, EWI's track record and Italy's export strength make it an appealing choice for those seeking diversification beyond typical markets. With inflation expected to remain below 2% in 2025-2026 and ongoing structural reforms, now may be a great time to add Italian exposure to your portfolio.

It's essential to have realistic expectations: EWI is not a core holding, but rather a focused investment in Italy's economic recovery. For investors seeking to capitalise on European opportunities, EWI offers a solid option to benefit from Italy’s resurgence.

EWI: The Italian Stallion of European ETF Investing

Ready to explore more ETF opportunities and strategies? Join the ETF UNO community today and discover how geographic diversification can enhance your investment journey. Together, we'll navigate the global markets and unlock opportunities from Milan to Manhattan.

DISCLAIMER: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Reply