- ETF UNO

- Posts

- 🧬 Biotech Unleashed: Discover Tomorrow's Medical Miracles with ETF IBB!

🧬 Biotech Unleashed: Discover Tomorrow's Medical Miracles with ETF IBB!

Introducing IBB: iShares Biotechnology ETF

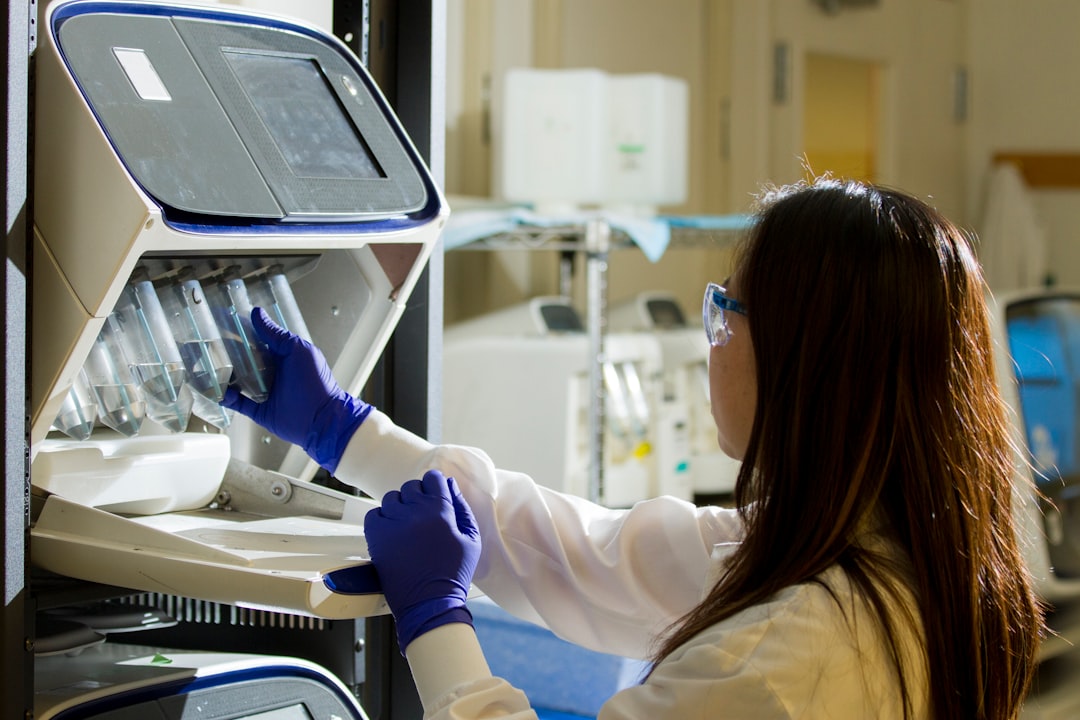

Amidst the vast realm of global health and scientific innovation, the biotechnology industry consistently rises to prominence. Biotech showcases its unmatched ability to drive a healthier and more resilient future by pioneering breakthrough treatments for complex diseases and delivering swift responses to challenges like COVID-19. This sector's agility shone as companies collaborated in novel ways, providing transformative solutions at an astounding pace. For those captivated by these significant milestones and eager to participate in this revolutionary journey, the IBB ETF offers a direct path to the trailblazers and innovators of the biotech world.

What is IBB?

IBB, which stands for the iShares Biotechnology ETF, is a notable fund that provides exposure to the biotechnology and pharmaceutical sectors of the US market. It tracks the ICE Biotechnology Index, which consists of companies that are primarily involved in the research, development, manufacturing, and distribution of various biotechnological products.

Managed by iShares (again😆) IBB offers investors a strategic gateway to follow leaders in the biotech game. IBB's portfolio consists of a wide range of companies, from titans of the industry to emerging players. Some of these include:

Gilead Sciences: A company known for its antiviral drugs used in treatments for HIV, hepatitis B, hepatitis C, and influenza.

Amgen: One of the world's leading biotech firms, with a focus on oncology, nephrology, bone health, and neuroscience.

Regeneron Pharmaceuticals: A company that has been at the forefront of developing drugs related to various diseases, including those for cholesterol management and allergic inflammation.

Why Biotech?

Biotechnology is a unique and exciting investment destination with the potential for high returns. It is beyond traditional pharmaceuticals, innovation-driven, has the potential for exponential growth, and is resilient to market dynamics.

🔬Beyond traditional pharmaceuticals: Biotech companies use cutting-edge technologies to develop new and innovative treatments.

💡Innovation-driven: Biotech is at the forefront of scientific discovery, with the potential to revolutionize healthcare.

📈Exponential growth: Biotech companies have the potential to generate significant returns, especially if they develop treatments for previously untreatable diseases. The demand for pioneering medical solutions remains consistent, regardless of economic trends.

Biotech's Frontier

Here are some specific examples of the unique investment opportunities that exist in the biotech sector:

Gene editing: Gene editing technologies such as CRISPR-Cas9 have the potential to revolutionize the treatment of genetic diseases, including cancer, sickle cell anemia, and cystic fibrosis.

Cell therapy: Cell therapy involves the use of a patient's own cells to treat diseases. This approach has the potential to be more effective and have fewer side effects than traditional drug therapies.

Artificial intelligence (AI): AI is being used in a variety of ways to develop new drugs and therapies, including drug discovery, clinical trial design, and patient care.

If you are looking for an investment opportunity with the potential to make a real difference in the world, then biotechnology is a sector worth considering.

AI is powering the next generation of biotechnology

IBB at a glance

Asset Class: Equities

Underlying Index: ICE Biotechnology Index (TR) (USD) - ICEBIOT

Geographical Focus: Global (all U.S. listed companies)

Sector Focus: Biotechnology and related industries

Expense Ratio: 0.45% (as of last data point)

Dividend Yield: 0.27% (as of last data point)

Rebalancing Frequency: Quarterly

Historical Performance

IBB has historically been considered a key benchmark for the biotechnology sector, reflecting the performance of prominent biotech and pharmaceutical companies in the U.S. Over the years, IBB has experienced periods of significant growth, particularly during times when the broader biotech sector witnessed advancements or when certain companies within the ETF made breakthroughs in their research and product pipelines.

However, like any investment, IBB has also seen volatility influenced by regulatory decisions, drug approval outcomes, market sentiment towards the healthcare sector, and broader economic conditions.

ETF Radar View

The radar chart below shows the general characteristics of the ETF:

IBB on the Radar

For each domain, higher scores indicate better suitability for investment

Top 3 Reasons to Invest in IBB

Exposure to the Biotech Sector: Investing in IBB provides diversified exposure to the biotechnology sector, allowing investors to tap into the potential of numerous leading companies without the need to research and invest in each one individually. This diversity can help mitigate company-specific risks.

Potential for High Growth: The biotech sector is known for its innovation-driven approach, leading to new discoveries and treatments. When a new drug or therapy gets approved and commercialized, it can result in substantial returns, making the sector (and thus IBB) an appealing growth opportunity.

Resilience to Economic Cycles: The demand for healthcare and new medical solutions often remains robust regardless of broader economic trends. As a result, the biotech sector and ETFs such as IBB can offer some resilience against market downturns.

Top 3 Reasons Not to Invest in IBB

Sector-Specific Volatility: While biotechnology has its growth potential, it is also a highly volatile sector. Drug development is risky, and not all treatments make it to market. Regulatory hurdles, clinical trial results, or patent disputes can lead to significant stock price swings.

High Competition and Uncertainty: The biotech industry is highly competitive. Many companies in the sector are racing to be the first to discover or market a particular treatment. Additionally, the science behind many therapies is complex, and outcomes can be uncertain.

Regulatory and Political Risks: Changes in healthcare regulations, pricing policies, or political sentiment can impact the profitability of biotech companies. For instance, discussions around drug pricing reforms can influence investor sentiment and sector performance.

Unlocking the Biotech Door with the Key 🔑

IBB is your ticket to a curated selection of top-tier biotech players, offering a ringside view of the sector's innovations and growth.

Yet, every investment has its turbulence. Biotech, with its roller-coaster volatility, cut-throat competition, and shifting regulatory sands, is no exception. Aspiring investors should balance the tantalizing prospects and inherent risks of IBB.

For those with an appetite for some volatility, IBB serves as a passport to a realm of trailblazing firms crafting next-gen drugs and transformative therapies, envisioning a stake in tomorrow's healthcare. IBB might be your pick. But strap in for a potentially thrilling journey! 🎢

DISCLAIMER: None of this is financial advice. This newsletter is 100% educational and is not investment advice to trade ETFs or any other assets or make financial decisions. Please be careful and do your research.

Reply