- ETF UNO

- Posts

- AGIX: Your All-Access Pass to the AI Revolution🧠

AGIX: Your All-Access Pass to the AI Revolution🧠

Explore how AGIX taps into the entire AI value chain — from hardware to applications🔍

Welcome back to ETF UNO, where we showcase the best opportunities in ETFs. Today, we’re focusing on the KraneShares Artificial Intelligence & Technology ETF (AGIX), one of the most exciting thematic ETFs in recent years. If you’re looking for diversified exposure to the rapidly growing AI sector—covering everything from chips and software to innovative disruptors—this article is for you. We’ll discuss what makes AGIX both interesting and risky, how it operates, its recent performance, and how to incorporate it into your ETF portfolio effectively.

How can AI power your income?

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

What is AGIX?

Launched on July 17, 2024, AGIX uses a unique strategy to capture the growth potential of artificial intelligence. It invests at least 80% of its net assets in securities from the Solactive Etna Artificial General Intelligence Index while being actively managed as an ETF. The selection process relies on a proprietary "AI Exposure Score" that assesses each company's AI relevance and AI readiness. This hybrid approach allows portfolio managers to seize opportunities outside the index while maintaining a disciplined stock selection framework.

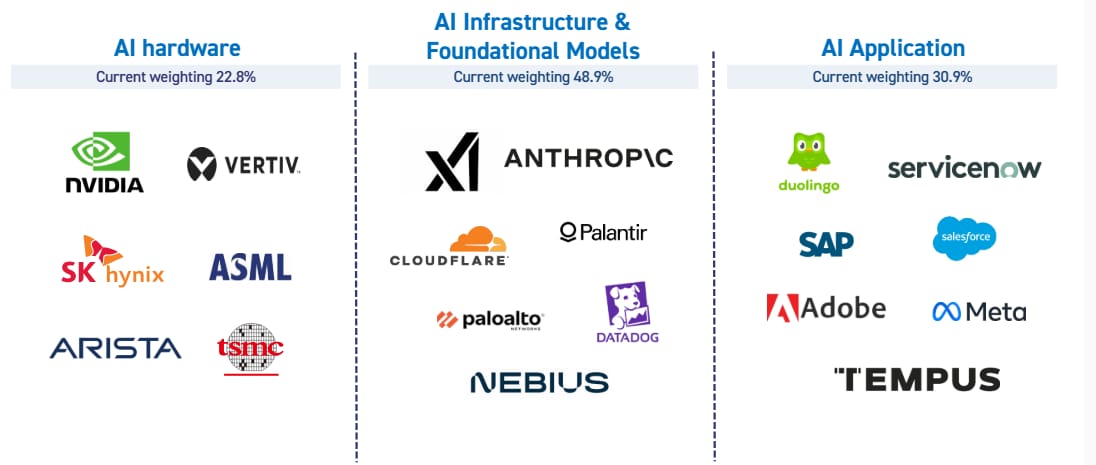

AGIX aims to address the entire AI value chain, divided into three main categories: hardware, infrastructure, and applications.

🏿Hardware: the chips, semiconductors, and physical compute power that underpin AI workloads.

🛜Infrastructure: cloud, data-centre, networking, and other backbone services that enable AI deployment at scale.

✨Applications: software, platforms, and services — including AI tools, services, and end-user applications.

This multi-layered exposure helps AGIX capture value irrespective of whether AI growth comes via breakthrough semiconductors, better infrastructure, or viral adoption of AI-powered apps.

AGIX: Full-Stack AI Exposure

AGIX stands out for its investment in private AI companies. Uniquely for a retail ETF, it includes holdings in private unicorns like xAI (Elon Musk's venture) and Anthropic (creators of Claude AI). This access to private markets, typically for institutional investors, gives AGIX shareholders a notable advantage in early-stage AI innovations.

AGIX Holdings. Source: KraneShares website

Investment Strategy📊

Given its profile, AGIX can serve different strategic roles in an ETF-based portfolio, depending on your risk appetite and time horizon. Here are some typical approaches:

🎯Core satellite with AI tilt: Use a broad low-cost index ETF (e.g., broad US equity or global equities) as the “core,” and add a position in AGIX as a “satellite” holding to tilt your portfolio toward high-growth AI exposure.

🧩Thematic allocation: If you believe AI will reshape multiple sectors over the coming decade, you might allocate a portion of your equity exposure to AGIX instead of or alongside other thematic or sector funds (e.g., technology, cloud, software).

🔥Risk-return enhancer: For more growth-oriented portfolios, AGIX can be a high-conviction active bet — acknowledging that with higher growth potential comes higher volatility.

🌠Long-term “moon-shot” allocation: Given its exposure to private AI ventures and emerging technologies, AGIX might appeal to investors willing to hold for many years, hoping that some private holdings explode in value.

Because AGIX includes private holdings and emerging-market-like volatility, it’s generally best as a diversified complement, not as the foundation of a portfolio.

AGIX at a glance

ETF Issuer: KraneShares

Inception: 2024-07-17

Asset Class: Equity

Underlying Index: AGIX is an active ETF

Geographical Focus: Global

Expense Ratio: 0.99% (as of last data point)

Dividend Yield: 0.31% (as of last data point)

Distribution Frequency: Annual

Historical Performance

Since AGIX launched in July 2024, its history is brief. As of November 30, 2025, AGIX’s price has increased by approximately 44.7% since its inception. Even within this short timeframe, this return emphasises AGIX’s potential for significant growth, likely fuelled by overall enthusiasm for AI and the incorporation of promising private AI companies.

ETF Radar View

The radar chart below shows the general characteristics of the ETF:

AGIX on the Radar

For each domain, higher scores indicate better suitability for investment

Top 3 Reasons to Invest

Comprehensive AI Ecosystem Exposure: Unlike many AI-focused ETFs that target only semiconductor companies or application developers, AGIX offers broader exposure across the entire AI value chain. It includes hardware manufacturers such as NVIDIA, infrastructure providers such as Microsoft's Azure, and application developers such as Meta's AI research. This approach allows investors to capture innovations across the AI ecosystem while minimising the risk of missing out on breakthroughs in any specific segment.

Unprecedented Access to Private AI Markets: Accessing private AI companies has often been challenging for retail investors due to high minimum investments and strict accreditation requirements. AGIX overcomes these barriers by investing in leading firms like xAI and Anthropic, enabling investors to benefit from the growth phase before a public offering and achieve returns typically inaccessible to individual investors.

Active Management in a Rapidly Evolving Sector: The AI landscape evolves rapidly, with constant breakthroughs and challenges. AGIX's active management allows portfolio managers to quickly adjust investments, increasing exposure to promising areas while reducing it in struggling segments. This adaptability is crucial in emerging technologies, where index-based strategies may lag behind new developments.

Top 3 Reasons Not to Invest

High Expense Ratio: AGIX has an expense ratio of 0.99%, which is higher than most broad market ETFs and sector-specific funds. This reflects the specialised investment strategy and costs of accessing private markets. While the unique exposure may justify the higher fees, investors should carefully weigh these costs against expected returns, particularly as passive strategies become more attractive in a rising interest rate environment.

Concentration Risk in the Technology Sector: AGIX focuses heavily on the technology sector, with major holdings in the Magnificent Seven. This concentration poses significant sector-specific risks due to potential regulatory changes or economic downturns. Investors should maintain sector diversification to mitigate these risks.

Liquidity Concerns with Private Holdings: Access to private companies provides advantages but also brings liquidity challenges. Private investments are less liquid than public securities, which can create redemption pressures during market stress. Furthermore, their valuation relies on periodic appraisals rather than real-time market prices, potentially leading to discrepancies between the ETF's net asset value and the market value of its holdings during volatile periods.

📈Betting Big on the Future of Intelligence

AGIX offers a unique investment opportunity with broad exposure to the AI value chain and access to private AI companies. While its strong early performance supports the investment thesis, potential investors should consider its high expense ratio, sector concentration and liquidity issues.

AGIX is best viewed as a satellite holding in a diversified portfolio, allowing investors to tap into AI's growth potential while managing risk. It is particularly suitable for those with a long-term horizon who can handle market volatility.

As with any investment, thorough research is essential. We encourage you to explore AGIX's holdings and strategy to see how they align with your investment goals.

Balanced AI Investment Outlook

Are you ready to dive deeper into the world of ETF investing? Join the ETF UNO community today for exclusive insights, portfolio strategies, and expert analysis that can transform your approach to ETFs. Visit ETFUNO.com to subscribe and enhance your ETF investing experience—because in the realm of ETFs, knowledge is power.

DISCLAIMER: This article is for informational purposes only and should not be considered as investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Reply